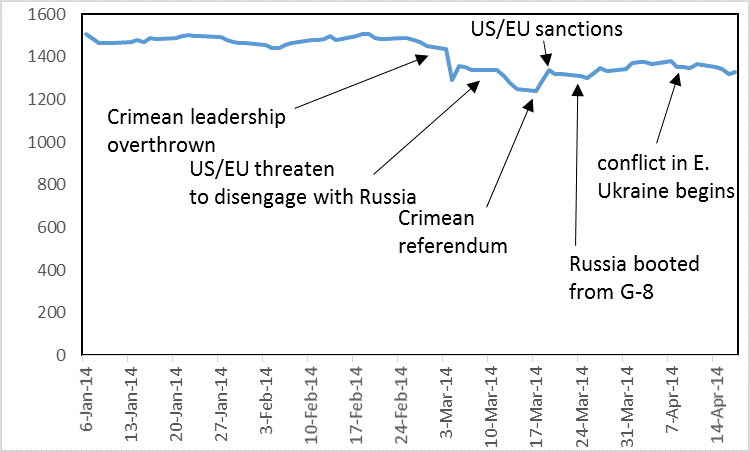

There has been a lot of loopy speculation about Putin’s motives, much of it based on conjectures about his psychological makeup. Some people think he is irrational. Another view, which is more plausible, is that he acts tactically in response to short-term opportunities but has no strategic vision. But this view is wrong as well. There is a simple, parsimonious explanation for Putin’s actions.

There has been a lot of loopy speculation about Putin’s motives, much of it based on conjectures about his psychological makeup. Some people think he is irrational. Another view, which is more plausible, is that he acts tactically in response to short-term opportunities but has no strategic vision. But this view is wrong as well. There is a simple, parsimonious explanation for Putin’s actions.

Putin sees the United States as a rival, not as a “partner,” and seeks to advance Russia’s interests by ensuring a sphere of influence around the Russian homeland. He has taken advantage of the fact that most of Russia’s neighbors have substantial ethnic Russian populations and, among these countries, most are poor and badly governed, except Estonia and Latvia. This means that Russia can, at low cost and risk, stir up unrest in these countries by encouraging the Russian populations to express separatist ambitions. It follows that countries without significant Russian minorities (like Finland) or are powerful (like China) have little to worry about. Russia today is not the Soviet Union; Poland (a non-neighbor with a tiny Russian population) has nothing to fear.

Putin is not interested in conquering his neighbors, which would be difficult to rule. He just wants them to be in Russia’s orbit. And so his strategy is to punish any neighbor that shows excessive pro-western inclinations by sowing disorder among the Russian speaking population. That is the story of Georgia and Ukraine. Russia would never have bothered annexing Crimea if a pro-Russian government remained in place in Ukraine. Where governments cooperate with Putin (Kazakhstan and Belarus), Putin does not trouble them.

This strategy is a less ambitious version of the Soviet Union’s strategy, and also not much different from what the United States did during the cold war, in places like Cuba and Nicaragua. It’s perfectly logical, and also likely to succeed because a big country cares more about its neighbors than other countries do, and can exert influence over them more easily than other countries can.

The implications for the West are also clear. It needs to decide whether the benefits of attracting Russia’s neighbors into the Western orbit are worth the risks of disorder that result from Russia’s retaliation. The bottom line, I fear, is that places like Georgia, Ukraine, and even Estonia are not important enough, in the long run, for the West to warrant conflict with Russia when Putin can stir up disorder at such little cost to the Russian treasury. Governments in those countries should do everything they can to appease their Russian populations so that they are not responsive to irredentist appeals from the Kremlin.

It seems to me that in the future the biggest problems will be Estonia and Latvia. Both are little countries with big Russian populations. Both are also NATO members, so the West is committed to defending them. Everything should be done to ensure the Russian minorities in those countries will be unresponsive when Putin starts stirring up trouble.

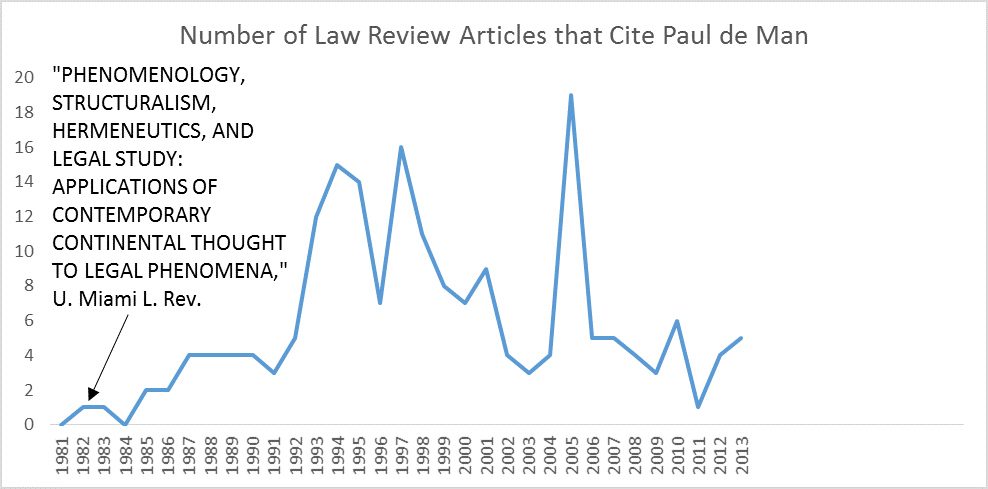

Lewisization and Gladwellization are synonyms for abuse of social science in the service of readability, or what one might prefer to call narrative-arcification. Lewis’ Flash Boys is the latest and most damaging because, while the book hovers around a real problem in financial markets related to high-frequency trading, it doesn’t identify it clearly or explain the need to regulate–indeed, one could finish the book thinking that the market cured itself.

Lewisization and Gladwellization are synonyms for abuse of social science in the service of readability, or what one might prefer to call narrative-arcification. Lewis’ Flash Boys is the latest and most damaging because, while the book hovers around a real problem in financial markets related to high-frequency trading, it doesn’t identify it clearly or explain the need to regulate–indeed, one could finish the book thinking that the market cured itself.

This very good student

This very good student  Have you read your iTunes contract–the one that Apple asked you to read and accept before using the service? No? Neither have I. It’s 55 pages long. How about the mortgage disclosures that accompanied your last refinancing? In Illinois, you would need to read 49 disclosure forms spread out over 101 pages. When I refinanced my mortgage, the huge stack of disclosures induced a faint bout of nausea but no wisdom. A professor who teaches contract law and banking law, I quickly gave up trying to understand what I was reading.

Have you read your iTunes contract–the one that Apple asked you to read and accept before using the service? No? Neither have I. It’s 55 pages long. How about the mortgage disclosures that accompanied your last refinancing? In Illinois, you would need to read 49 disclosure forms spread out over 101 pages. When I refinanced my mortgage, the huge stack of disclosures induced a faint bout of nausea but no wisdom. A professor who teaches contract law and banking law, I quickly gave up trying to understand what I was reading.

As the magnitude of the harms from climate change becomes clearer, poor countries have redoubled their efforts to achieve “climate justice”–large sums of money from rich countries, at least $100 billion, to compensate them for the harm caused by climate change. As the New York Times

As the magnitude of the harms from climate change becomes clearer, poor countries have redoubled their efforts to achieve “climate justice”–large sums of money from rich countries, at least $100 billion, to compensate them for the harm caused by climate change. As the New York Times