Via a helpful review by Daniel Farber, I found out about this book, which is a much-needed one. I have searched in vain for some time for an overall assessment of deregulation in the United States. Unfortunately, if the remit of McGarity’s beloved Consumer Protection Safety Commission extended to books, this one would have to be recalled.

Via a helpful review by Daniel Farber, I found out about this book, which is a much-needed one. I have searched in vain for some time for an overall assessment of deregulation in the United States. Unfortunately, if the remit of McGarity’s beloved Consumer Protection Safety Commission extended to books, this one would have to be recalled.

McGarity argues that the deregulation movement arose from a conspiracy between business interests and right-wing intellectuals, who hoodwinked Congress and the public. In fact, deregulation was largely a bipartisan movement that started in the Carter administration, and reflected an emerging consensus that many (but not all) regulations did more harm than good–in particular, rate regulation. McGarity barely discusses or discusses not at all airline, trucking, and railroad deregulation of the 1970s, which generally has received high marks, or the resistance of business interests to some forms of deregulation–all of this contrary to this thesis. He is certainly right that a lot of deregulation went too far–notably financial deregulation–but because he refuses to provide a realistic baseline for determining whether deregulation benefits or harms the public, he provides no reasonable method for distinguishing between good deregulation and bad deregulation or, for that matter, good regulation and bad regulation.

Instead, he resorts to anecdotes. One of the weakest chapters discusses transportation safety, and he includes some distressing anecdotes of terrible accidents that he blames on deregulation. But transportation safety has greatly improved over the period of deregulation. Numerous studies show that railroads, airlines, passenger vehicles, and other modes of transportation are vastly safer today than they were in the 1970s. McGarity acknowledges some of these statistics at the beginning of the chapter, but by the end he has forgotten them, and instead pronounces deregulation a disaster for safety. Nor does he acknowledge the economic benefits from transportation deregulation, which have been extensively documented by economists.

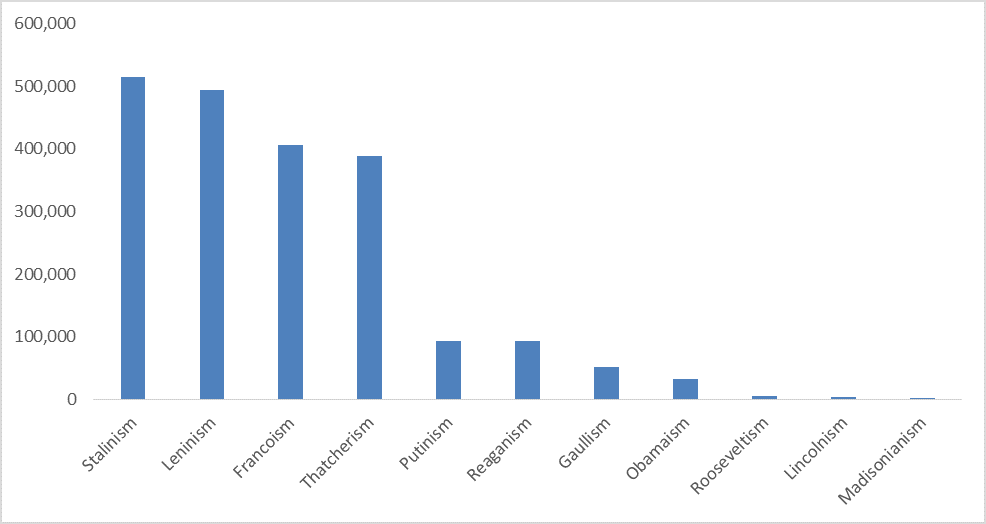

Similar points can be made about other chapters, for example, the chapter on workplace safety, which provides a tendentious picture of mine safety being utterly neglected, when in fact safety has steadily improved (as shown by the graph above). The fatality rate dropped from 0.200 (1970) to 0.059 (in 1980) to 0.016 (in 2010) fatalities per 100,000 workers in coal mines. Certainly, stricter regulation would have caused the fatality rate to drop even further, but would it have been worth the cost? No answer is provided.

Another lurking question is the extent to which deregulation actually took place. As Farber notes, the evidence is often equivocal. The sheer number of rules has greatly increased; budgets are a more complex story, but private rights of action have also become more important. When rate regulation in the railroad and telecommunications sectors were eliminated, it was also thought necessary to introduce regulations to ensure free entry, leading to quite complex regulatory regimes. Airline safety was never deregulated; the fear was that price competition would lead to less safe airlines. What exactly deregulation is, and whether it has had good or bad effects, are important questions. We’ll need to wait for another book for the answers.

Back in the 1990s, there was a lot of interest among law professors about the interaction between law and social norms. There were several conferences. I wrote a

Back in the 1990s, there was a lot of interest among law professors about the interaction between law and social norms. There were several conferences. I wrote a  This

This  Have you read your iTunes contract–the one that Apple asked you to read and accept before using the service? No? Neither have I. It’s 55 pages long. How about the mortgage disclosures that accompanied your last refinancing? In Illinois, you would need to read 49 disclosure forms spread out over 101 pages. When I refinanced my mortgage, the huge stack of disclosures induced a faint bout of nausea but no wisdom. A professor who teaches contract law and banking law, I quickly gave up trying to understand what I was reading.

Have you read your iTunes contract–the one that Apple asked you to read and accept before using the service? No? Neither have I. It’s 55 pages long. How about the mortgage disclosures that accompanied your last refinancing? In Illinois, you would need to read 49 disclosure forms spread out over 101 pages. When I refinanced my mortgage, the huge stack of disclosures induced a faint bout of nausea but no wisdom. A professor who teaches contract law and banking law, I quickly gave up trying to understand what I was reading. William Easterly

William Easterly

Via a helpful

Via a helpful