Adrian Vermeule and I finally finished and posted our paper at SSRN. It started out as a few blog posts wondering whether a judge can deem a statute “clear” if other judges who have interpreted it disagree about its meaning. See here, here, and here.

Category Archives: MISC.

What Legal Authority Does the Fed Need During a Financial Crisis?

A new paper, at SSRN:

The financial crisis of 2007-2008 exposed gaps in the law that authorizes federal agencies to provide emergency liquidity support. This essay describes the ways in which legal constraints hampered response to the crisis, proposes reforms that would make possible a unified and strong response, and criticizes the Dodd-Frank Act for weakening, rather than strengthening, the crisis-response agencies.

Cruz’s eligibility for the presidency and the Naturalization Act of 1790

The Naturalization Act provides:

And the children of citizens of the United States that may be born beyond Sea, or out of the limits of the United States, shall be considered as natural born Citizens: Provided, that the right of citizenship shall not descend to persons whose fathers have never been resident in the United States: Provided also, that no person heretofore proscribed by any States, shall be admitted a citizen as aforesaid, except by an Act of the Legislature of the State in which such person was proscribed.

Michael Ramsey argues that this language “strongly supports” the view that Cruz is a natural born citizen. Congress’ approach is “consistent with the eighteenth-century English parliament’s view that it could define natural born subject as it pleased (and indeed could tinker with the definition for policy reasons).” Or, as he puts it, a “natural born citizen” means “entitled to citizenship by whatever statute was in effect at the time of the person’s birth.”

But this is circular. Under Ramsey’s definition, the Naturalization Act provides that “the children of citizens of the United States [born on foreign soil] … shall be considered as entitled to citizenship by whatever statute was in effect at the time of the person’s birth”—namely, the Naturalization Act itself! The definition swallows its own tail.

The Naturalization Act uses a legal fiction as so many statutes do. Consider the Dictionary Act, which provides that the word “person” includes a corporation unless the context indicates otherwise. The Dictionary Act presupposes that the ordinary meaning of person is someone with a physical body and a beating heart. If the ordinary meaning of the word person encompassed corporation, then the Dictionary Act definition would not be necessary. People would read “person” to mean “corporation” without having to be told to. The Dictionary Act in this way is consistent with, and at some future point could be taken as evidence for, the proposition that the ordinary meaning of person excludes corporations. (By the way, over time courts came to refer to a non-corporate person as a “natural person,” again reinforcing the idea that we put natural before a term to refer to the regular or normal, as opposed to technical, usage.)

Similarly, the Naturalization Act assumes that “natural born citizen” does not include foreign-born children of Americans. That’s why it’s necessary to redefine this term to include foreign-born children. Enacted shortly after the Constitution was ratified, the law assumes that ordinary readers of the Constitution would have interpreted “natural born citizen” to mean only those born on American soil.

Is Cruz eligible for the presidency?

Michael Ramsey, in his excellent article on the meaning of “natural born citizen,” argues that the founders likely used that term with British precedent in mind. In a series of statutes, Parliament redefined the common-law definition of “natural born subject”—which meant born on UK territory, with some minor exceptions—to encompass people born on foreign territory to a British father, a necessary elaboration in an era when large numbers of British subjects spent years abroad roaming around in service of foreign-born British monarchs while spawning offspring. Blackstone discusses this history; the founders read Blackstone; ergo the founders likely had Blackstone in mind when they agreed on the term “natural born citizen,” replacing subject with citizen but preserving the meaning of “natural born.”

But did the population at large? Most people weren’t lawyers, fewer still read Blackstone, and in the current version of originalism—of which Cruz is an enthusiastic adherent—the relevant question is the “public meaning” of the Constitution when it was ratified. I checked Samuel Johnson’s dictionary, which does not contain an entry for “natural” but does include “nature.” The most pertinent of the definitions is “the regular course of things.” Citizenship, in the regular course of things, came to those who were born on U.S. territory. The complex process known as “naturalization”—by which an alien becomes a citizen after jumping through various hoops—reinforces this idea. People who are not citizens in the regular course of things (by birth on U.S. territory) can become citizens through operation of law.

The Constitution withholds the presidency from those who are “naturalized,” reserving the prize only for those whose citizenship is natural. The vast majority of Americans at the time who were not naturalized aliens were citizens of the various states because they were born in the states. Citizenship in “the regular course of things” would mean citizenship by virtue of birth on U.S. territory.

My argument would be strengthened if the practice in the states in the eighteenth century was to require people born abroad whose parents were U.S. (and/or state) citizens apply for naturalization. I am not aware of evidence in either direction.

What do the presidential candidates think are the limits on presidential power?

The major presidential candidates refused to answer Savage’s survey of their views about executive power. Why not? They did in 2011 and 2007. The survey was designed from the beginning to force candidates to acknowledge limits on their power if elected. Savage, like most commentators, has persuaded himself that Americans think that presidents have too much power. He made his name by documenting Bush-era executive-power abuses, and he has just published a book about Obama’s abuses as well. But it seems to be dawning on him that Americans want limits on executive power only when they don’t like the president in office. Today, Republicans complain about presidential power; eight years ago, Democrats complained. The opposition is tactical, skin-deep, which is why serious limitations on executive power—either self-imposed in response to public opinion, or imposed by the other branches—will not take place anytime soon. Americans want a strong president to solve their problems, and the candidates know this.

Greg Lukianoff and I debate campus speech

Yosemite

The Big Short

I was wondering whether this film would really be able to explain collateralized debt obligations, cdo-squareds, credit default swaps, and all the rest, as the reviews suggested. When I explain these things to students, I need to write out diagrams showing cash flows, and then spend more time explaining why people created them, how they worked, and what went wrong. It takes a long time and is pretty boring. The movie’s approach was to put a woman in a bubble bath who spends 10 seconds explaining what one of these instruments was (I forget which one–the woman in the bubble bath was distracting), and to use a Jenga set as a prop for a CDO. Occasionally, celebrities were brought out to explain things. Anthony Bourdain says that a CDO-squared has something to do with reusing old Halibut in a fish stew. Even Dick Thaler, who makes an appearance, let me down. He says that the hot hand fallacy explains the financial crisis (it doesn’t–and apparently it has been debunked anyway). I suspect Thaler was happy enough to read the script, whatever it happened to say, so he could appear in a movie and meet Selena Gomez.

I was wondering whether this film would really be able to explain collateralized debt obligations, cdo-squareds, credit default swaps, and all the rest, as the reviews suggested. When I explain these things to students, I need to write out diagrams showing cash flows, and then spend more time explaining why people created them, how they worked, and what went wrong. It takes a long time and is pretty boring. The movie’s approach was to put a woman in a bubble bath who spends 10 seconds explaining what one of these instruments was (I forget which one–the woman in the bubble bath was distracting), and to use a Jenga set as a prop for a CDO. Occasionally, celebrities were brought out to explain things. Anthony Bourdain says that a CDO-squared has something to do with reusing old Halibut in a fish stew. Even Dick Thaler, who makes an appearance, let me down. He says that the hot hand fallacy explains the financial crisis (it doesn’t–and apparently it has been debunked anyway). I suspect Thaler was happy enough to read the script, whatever it happened to say, so he could appear in a movie and meet Selena Gomez.

The movie’s creators faced a problem. How do you make a compelling story about the financial crisis for moviegoers who wouldn’t know a CDO from a cabbage. The brilliant solution was to pretend to explain what these concepts were rather than to explain them, so that the viewer would not be distracted from the glittering images and sharp dialogue by the nagging sense that he has no idea what is going on. The violation of the normal customs of movie making–including the breaking of the fourth wall by the actors–would enhance the viewers’ sense that what they were seeing was really true, and not only true but important enough to risk a collapse in verisimilitude which is normally maintained by keeping the fourth wall intact.

The relationship between the movie and reality is bewildering. The movie is based on Lewis’ nonfiction book, but only loosely–with most (but not all) of the characters’ names changed so as, I suspect, to allow the film makers to invent colorful details about them (various humanizing traumas, etc.). Lewis’ book itself, while apparently accurate in the details, gives a deeply misleading interpretation of the financial crisis that fits his crowd-pleasing template of eccentric outsiders versus complacent suits. If Lewis’ book was misleading, the movie is a CDO-squared version. Short it.

Legal realism and the driverless car

From Bloomberg View:

Turns out, though, their accident rates are twice as high [for driverless cars] as for regular cars, according to a study by the University of Michigan’s Transportation Research Institute in Ann Arbor, Michigan. Driverless vehicles have never been at fault, the study found: They’re usually hit from behind in slow-speed crashes by inattentive or aggressive humans unaccustomed to machine motorists that always follow the rules and proceed with caution.

Could an anti-propaganda law stop recruitment by ISIS in the US?

I discuss in Slate.

So you want to be a lawyer…

Be sure to watch this video first.

The bin Laden raid: where was the OLC?

The Times article describing the legal deliberations prior to the bin Laden raid mentions four lawyers: the CIA’s general counsel; the NSC’s legal adviser; the Joint Chiefs’ legal adviser; and the Pentagon general counsel. All of them, of course, did what executive-branch lawyers do: identify the most convenient legal categories needed for permitting the executive action.

More interesting, the OLC–which would normally be called upon to render the final opinion–was not included. Not just the OLC, but the entire Justice Department was frozen out. Why? Could it be that the OLC was less than cooperative when the White House sought a legal rubber stamp for the Libya intervention in 2011? Has the OLC been demoted for its insubordination?

Richard McAdams on Go Set a Watchman

Read this review; it is the best thing written about Harper Lee’s new-old novel. Bottom line:

The 1950s editorial decision not to shepherd a revised Watchman to publication is more questionable than the decision to publish the first draft in 2015. It might not have been as popular as Mockingbird, but it would have been a better novel.

Partisanship and the supreme court: summary

| Agrees with co-partisans | Disagrees with co-partisans | |

| Agrees with counter-partisans | Bridge-builders: Kennedy, Roberts | Traitors: ∅ |

| Disagrees with counter-partisans | Loyalists: Kagan, Ginsburg, Breyer, Sotomayor, Scalia, Alito | Mavericks: Thomas |

Something like this. Perhaps, Justice Stevens could be classified as a traitor (to his party–he was appointed by Nixon Ford but in later years voted with the Democratic appointees–which is not the same thing as saying that he was a bad justice, of course). Among the loyalists, Scalia and Alito vote in a less consistently partisan manner than the other four.

The table is based on my previous posts: here, here, and here.

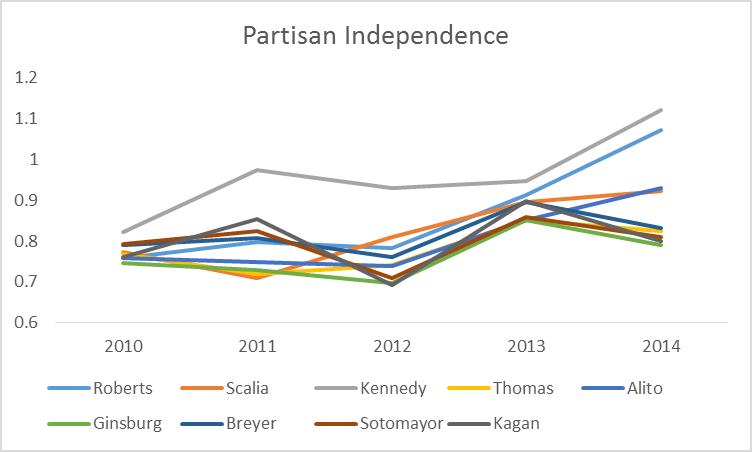

Partisan independence on the supreme court

Define partisan independence as the ratio of cross-party agreement to cross-party disagreement. Partisan independence is highest for those who both frequently disagree with co-partisans and frequently agree with counter-partisans. Kennedy and Roberts lead the pack. In the second group are Scalia and Alito. Thomas now clusters with the Democrats. While Thomas often disagrees with co-partisans, he also often disagrees with counter-partisans–the two tendencies cancel out.

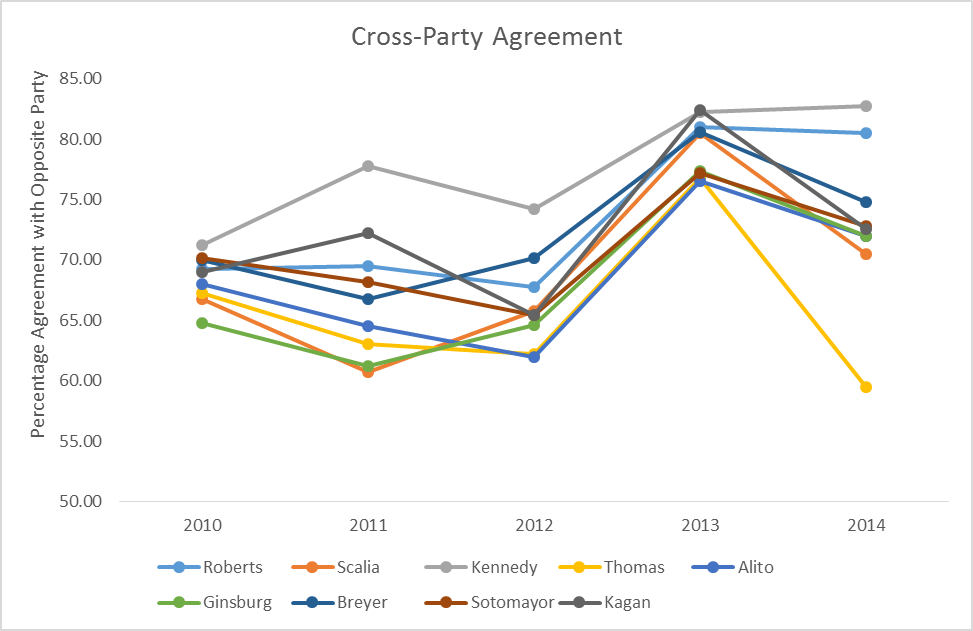

Cross-party agreement in the supreme court

Here is another angle on the relationship between partisan identity and agreement on the supreme court. Three clusters appear. Kennedy and Roberts are most likely to vote with counter-partisans–in their case, the Democratic justices. Thomas (a cluster of one) is least likely to vote with counter-partisans. The remaining justices–the four Democrats, Scalia, and Alito–fall in the middle. As before the 2014 term seems to magnify trends that are perhaps (with the benefit of hindsight) partly discernible in earlier years. Data from Scotusblog.

Here is another angle on the relationship between partisan identity and agreement on the supreme court. Three clusters appear. Kennedy and Roberts are most likely to vote with counter-partisans–in their case, the Democratic justices. Thomas (a cluster of one) is least likely to vote with counter-partisans. The remaining justices–the four Democrats, Scalia, and Alito–fall in the middle. As before the 2014 term seems to magnify trends that are perhaps (with the benefit of hindsight) partly discernible in earlier years. Data from Scotusblog.

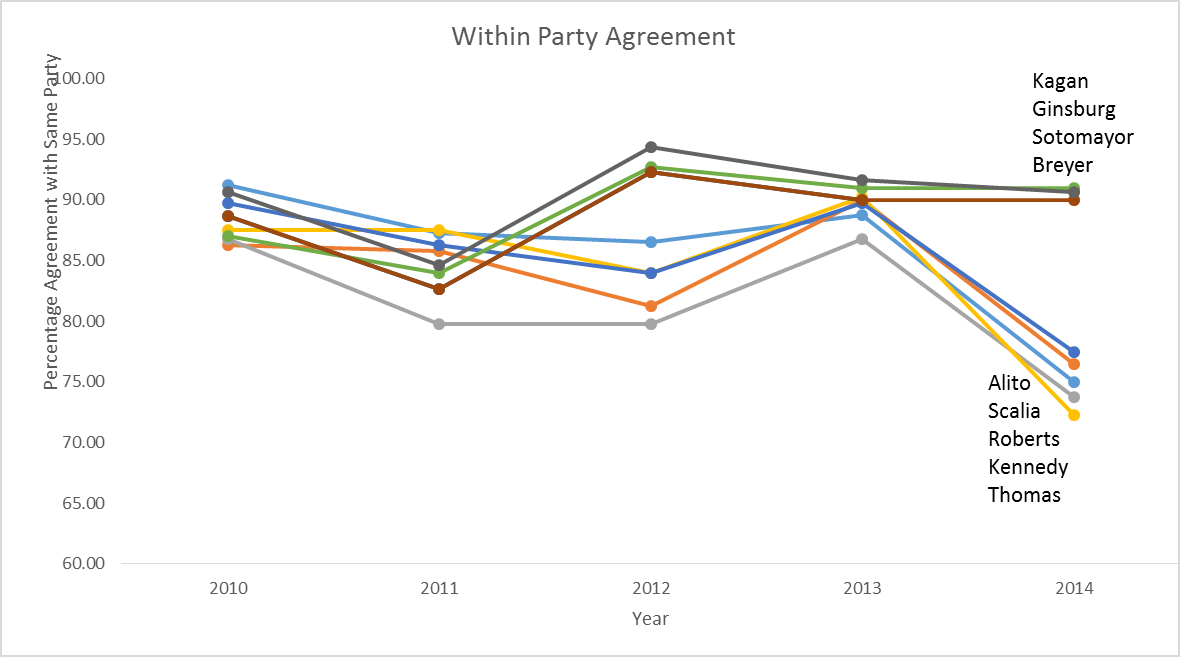

Partisan agreement in the supreme court

This graph shows that Republican-appointed justices disagree among themselves more often than Democrat-appointed justices, who march almost in lockstep. What accounts for the striking acceleration of the trend this year? While some of the most polarizing cases have not yet been decided, I’d be surprised if the final cases make much difference in the pattern. Data source: Scotusblog.

This graph shows that Republican-appointed justices disagree among themselves more often than Democrat-appointed justices, who march almost in lockstep. What accounts for the striking acceleration of the trend this year? While some of the most polarizing cases have not yet been decided, I’d be surprised if the final cases make much difference in the pattern. Data source: Scotusblog.

The law, economics, and psychology of manipulation

You probably didn’t know there was a law against manipulation. But I argue that you can find an anti-manipulation principle buried in the common law. I make this argument in a comment on Cass Sunstein’s paper Fifty Shades of Manipulation, his defense of libertarian paternalism against critics who argue that libertarian paternalism is “manipulative.”

Has the Supreme Court become less ideological?

Or, maybe I should have asked: Have the Republicans on the court become less ideological?

| Justice | Same-Party Agreement, % | Opposite-Party Agreement, % | Propensity to Same-Party Agreement |

| Roberts | 74.5 | 82.3 | 0.91 |

| Kennedy | 73.8 | 84.8 | 0.87 |

| Scalia | 76.5 | 74.3 | 1.03 |

| Alito | 77.3 | 75.3 | 1.03 |

| Thomas | 73.5 | 62 | 1.19 |

| Breyer | 92.7 | 82.5 | 1.12 |

| Ginsburg | 91.3 | 75.2 | 1.21 |

| Sotomayor | 91.3 | 74 | 1.23 |

| Kagan | 90.7 | 77.3 | 1.17 |

The numbers in the second and third columns are averages derived from Scotusblog (scroll down to the bottom). The last column is the second column divided by the third, so >1 means greater agreement with co-partisans.

Roberts and Kennedy are more likely to agree with the Democrats than with the other Republicans. I don’t think this has happened before. Last year, Roberts agreed with his co-partisans 88.8% of the time, and his opposite-partisans 81% of the time. For Kennedy, it was 86.8% and 82.25%. The Democrats and Thomas follow the ideologically polarized pattern of prior years.

Martin Schmalz: How passive funds prevent competition

Guest post by Martin C. Schmalz, University of Michigan.

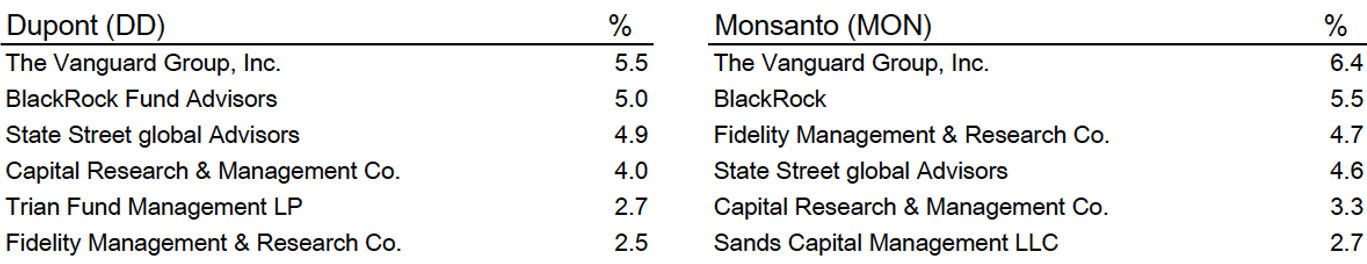

Last week, Nelson Peltz’s hedge fund Trian lost a proxy fight at DuPont. The outcome of the battle received much attention, among others because the “passive” investors Vanguard, BlackRock, and State Street were instrumental in making his bid fail – they voted against him. Commentators have ex-post rationalized the failure of the campaign with gaps in some of Peltz’s arguments, his personality, and other factors. Curiously, nobody seems to have taken a look at how Peltz’s and the “passive” funds’ economic incentives differed. This note takes a first look at those, and comes to rather interesting conclusions.

According to Trian’s presentation filed with the SEC, the primary goal of Peltz’s campaign was to help DuPont achieve “best in class revenue growth.” He points out that DuPont’s performance in recent years was satisfactory only because of a positive industry-wide trend, but not if measured relative to DuPont’s competitors. Note for later that the first peer mentioned for comparison in the presentation is Monsanto. A second point of critique concerned DuPont’s lack of aggressive investment in R&D and other measures to gain market share. Third, Trian criticizes DuPont’s CEO for selling a large fraction of her shares in DuPont under the tenure of the index funds, a move that weakened her incentives to make DuPont perform well as an individual firm and strengthen the firm’s relative competitive position. Fourth, Peltz criticizes that DuPont willingly violated a Monsanto patent, then chose to pay $750m more than required in a settlement, and entered a licensing agreement with Monsanto until 2023, effectively pre-committing future cash flows to the competitor. Peltz also criticizes DuPont for “paying competitors” for such licenses more generally.

Peltz’s arguments make perfect sense according to the conceived wisdom reflected in corporate finance textbooks, which assume that all shareholders are undiversified: Peltz’s motion for an increased use of relative performance evaluation, for steeper CEO incentives and against wealth transfers to competitors at the expense of DuPont’s shareholders – textbooks would consider all of these measures value-enhancing improvements of DuPont’s corporate governance. Also, Institutional Shareholder Services (ISS), a proxy advisory firm, supported Peltz’s campaign.

As we know since last week, these arguments left DuPont’s largest shareholders – the diversified investors Vanguard, BlackRock, and State Street – unimpressed. They voted against Peltz, leading to a rejection of his bid, and a multi-billion dollar drop in DuPont’s stock price (indicating the market also thought DuPont would have been more valuable with Peltz on the board). So why did the mutual funds not share Trian’s goals?

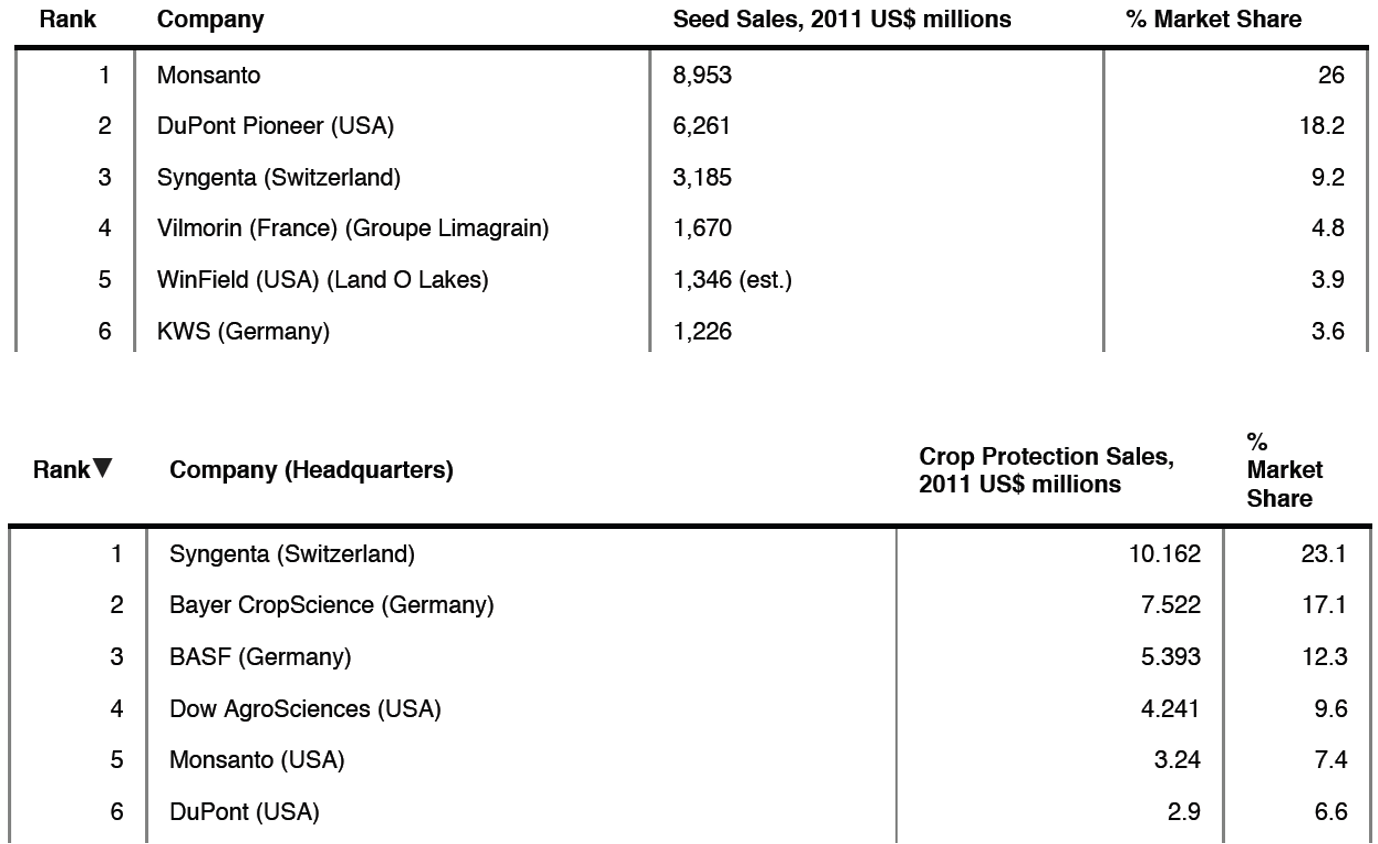

To answer that question, it is instructive to see who DuPont’s competitors are. A quick browse gives a first indication why Peltz considers Monsanto to be DuPont’s primary competitor: Monsanto and DuPont are the two firms dominating the seeds market, and Monsanto is DuPont’s next-largest competitor in the fertilizer and pesticides market. Conversely, these two markets generate almost all of Monsanto’s revenue.[1]

Peltz believes competing harder would increase DuPont’s value. For example, DuPont could decrease prices in the seeds market, and thus increase its market share. The stock market, as indicated by the stock price reaction amid the news of Peltz’s failed bid, appears to agree. The lower market prices for seeds would also lead to greater output and ultimately lower product prices for consumers – for short, greater economic efficiency. However, it would hurt Monsanto’s shareholders if DuPont were to compete more aggressively: DuPont’s increase in market share would come at the expense of Monsanto’s. So who are Monsanto’s shareholders?

It turns out that the same “passive” funds that helped reject Peltz’s bid at DuPont are – in the same order – also the dominant shareholders of Monsanto. In fact, with the exception of Peltz’s Trian Fund, the two firms’ top shareholders are almost identical.

The “passive” funds have no reason to object against cash transfers from DuPont to Monsanto – it’s just a transfer from one pocket to the other. Of course, Peltz (and everyone else who has a sufficiently steep interest in DuPont’s value) should object. That is the first source of imperfectly aligned incentives between the passive funds and Trian.

The more important insight, however, is that the common shareholders of the two firms would suffer from increased competition. Because prices would be lower, so would be the combined revenue and profits of DuPont and Monsanto. That outcome is in strict discord with the economic interests of Vanguard, BlackRock, and State Street. That is the second – and socially important – source of disagreement between the economic interests of Trian and the mighty mutual funds.

Here is one last nugget. Guess which company among DuPont’s competitors experienced a major change in stock price while DuPont’s price dropped in response to the news that Peltz’s bid failed. From market close on Tuesday to opening on Thursday, Monsanto’s shares gained 3.5%.

It appears that a dispassionate look at different shareholders’ economic incentives supplies a rather simple rationale for why the passive funds did not themselves enforce relative performance evaluation, protest the weakening of DuPont’s CEO’s incentives, encourage more R&D and gains in market share, and so forth.[2] Doing so simply isn’t in their economic interest. Peltz’s campaign, by contrast, aimed at increasing DuPont’s value in isolation, by strengthening DuPont’s relative competitive position. Predictably, the mutual funds voted against him.[3]

Before we conclude, pay attention to the dog that didn’t bark: Peltz’s failed campaign sends a strong signal to activists with similar goals as those Peltz tried to advance. If not before, then now they know: the combination of the index funds’ economic interests and voting power makes it unlikely that a campaign aimed at tougher competition will pass the ballot – so it might not be worth it to target a firm with these goals in mind in the first place.[4] That is how common ownership by “passive” funds can cause anti-competitive outcomes. If we want lower product prices, and higher output and efficiency, then taking a close look at the power and industrial organization of the asset management industry might be a good place to start.

[1] I haven’t gotten around to finding data on DuPont’s other product markets, which is why the following analysis is limited in scope and the external validity of its conclusions.

[2] Of course, this analysis does not prove that the passive funds voted against Peltz because he wanted DuPont to outperform the peers held by the passive funds, or because he criticized the voluntary wealth transfers to Monsanto and the lack of steep CEO incentives. Yet, whatever the reasons why the passive investors voted against Peltz, be it their economic incentives or other considerations, it is undisputable that their vote did prevent a campaign aimed at tougher competition. They thus caused less competition, compared to what it otherwise would have been.

[3] This outcome was indeed predicted. In this paper, my coauthors José Azar, Isabel Tecu, and I wrote: “owners generally need to push their firms to aggressively compete, because managers will otherwise enjoy a “quiet life” with little competition and high margins. Only shareholders with undiversified portfolios have an incentive to engage to that effect, while only large shareholders have the clout to do so. However, the largest shareholders of most firms tend to have diversified portfolios and therefore reduced incentives to push for more competition, whereas smaller undiversified investors don’t have the power to change firm policy without the support of their larger peers.”

[4] Opportunities abound for activist campaigns that didn’t or will never happen: very many U.S. firms are commonly owned by a similar set of diversified mutual funds as those owning DuPont and Monsanto. Here are a few examples.