I talk with Jack Goldsmith about my new book on the Lawfare podcast.

I talk with Jack Goldsmith about my new book on the Lawfare podcast.

Category Archives: MISC.

Coming soon!

Pre-order here.

The impeachment trap

I argue that the Trump impeachment looks like a repetition of the Clinton impeachment, and this is not a good thing. At Project Syndicate.

Meritocracy / Noncompetes

I have posted a review of various books relating to meritocracy at Project Syndicate.

And here is a new paper that asks why antitrust law is so easy on covenants not to compete:

Abstract. Employee covenants not to compete bar workers who leave their jobs from working for a competing employer for a period of time. The common law regards noncompetes as restraints of trade and imposes a “reasonableness” standard on them; they can also be challenged under the antitrust laws. But new research suggests firms frequently abuse noncompetes, causing significant harm to workers and to the economy. The existing legal approach is inadequate because the common law offers minimal sanctions and antitrust law imposes excessive burdens of proof on plaintiffs. While antitrust law is the appropriate vehicle for challenging noncompetes because of its focus on market effects, it needs to be strengthened.

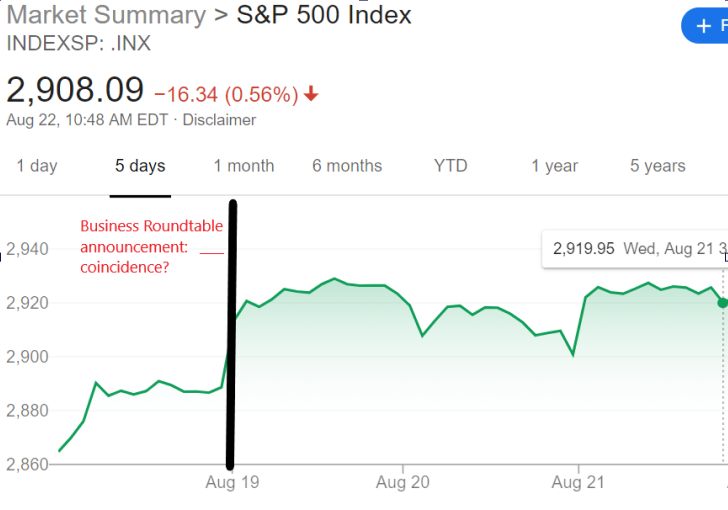

Milton Friedman Was Wrong

Sure, Business Roundtable’s repudiation of Milton Friedman’s theory that corporations should maximize shareholder value is empty PR from business leaders worried about the country’s ideological shift to the left. But it’s a good opportunity to explain why Friedman was wrong in the first place, which I do in The Atlantic.

Libra: not a good idea

I present some objections in The Atlantic. The structure of Libra in Facebook’s white paper suggests something like a money market mutual fund with a floating net asset value. When you buy a Libra, you’re buying a share of this mutual fund, which you can transfer to others over the internet, using Facebook’s social network among other platforms. If enough people buy in, Libra could work as a currency—where the currency value is simply the relevant fraction of the assets in the mutual fund (the “Reserve”). The assets include national currencies and government bonds. The holder of a Libra takes currency risk but probably not much, especially if it is easy to exchange a Libra back into one’s national currency. The structure of Libra is open-ended enough that the “Libra Association”—a club of big corporations with a handful of nonprofits thrown in—could easily convert Libra into a bank by changing the portfolio mix and adding some risk. I imagine that Facebook’s/Libra’s lawyers are working hard to persuade regulators that Libra is not a money market mutual fund / bank so as to avoid the relevant regulations, and are gambling that the Libra Association’s structure as an international organization (located in Switzerland) with enormous assets (distributed around the world) will force (national) regulators to make concessions.

What could go wrong? Read here to find out.

The human rights wars heat up!

For the past decade or so, a bunch of academics has debated whether international human rights law has improved human rights outcomes. In my book The Twilight of Human Rights Law, I argued “no,” but many other academics have disagreed with me, including Beth Simmons, and most recently, Kathryn Sikkink, in her book Evidence for Hope.

But while we, and many others, have argued about statistical significance, causation, and definitions, we missed, or at least gave insufficient attention to, the bigger story. That story is the redefinition of human rights to give them “conservative” content. Under the traditional definition, human rights was understood in either “liberal” (think of the U.S. Bill of Rights) or “social democratic” (think of Sweden, or anyway what we like to imagine Sweden to be) terms. Around the periphery, to be sure, other conceptions existed. Many Islamic countries argued that human rights law protected people against “defamation of religion,” which in practice meant restrictions on free speech where it offended religious sensibilities, while China’s “right to development” was supposed to excuse certain human rights violations until poverty was taken care of. But these views were never taken seriously by the dominant human rights community, consisting largely of liberal NGOs like Human Rights Watch, international human rights courts, and governments in the powerful liberal democratic countries, and never gained traction.

This may soon change. On May 30, a short notice appeared in the Federal Register announcing the formation of the “Department of State Commission on Unalienable Rights.” The Notice says that the “The Commission will provide fresh thinking about human rights discourse where such discourse has departed from our nation’s founding principles of natural law and natural rights.” The Charter (courtesy of Just Security) adds that “The Commission’s charge is not to discover new principles, but to recover that which is enduring for the maintenance of free and open societies.”

These statements give us little to go on, but commentators have begun to speculate, rightly in my view, that “natural law” and the anachronistic use of “unalienable” rather than “inalienable,” are meant to invoke the Christian, and especially Catholic, understandings. (The Declaration of Independence refers to “unalienable rights” with which people “are endowed by their Creator.”) And, given what we know about the Trump administration, this almost certainly means that the U.S. government will argue that abortion and possibly other forms of family planning violate “human rights;” and, I suspect, will, following the Organization of the Islamic Conference, mutatis mutandis, put greater emphasis on religious rights and freedoms as a matter of international human rights law.

The political scientist Clifford Bob wrote an eye-opening book back in 2012 entitled The Global Right Wing and the Clash of World Politics, in which he documented the ways that conservative activists from the United States traveled to foreign countries where they helped like-minded locals enact laws protecting gun rights, banning abortion, and criminalizing homosexual activity. In the Monkey Cage, he rightly sees the Trump commission as a continuation of these efforts, now more formal and legitimate, under government auspices—and harder to ignore. As he observed, “The commission will find allies not only among conservative Americans but also internationally. For every left-wing NGO promoting today’s dominant conceptions of human rights, there is a right-wing NGO promoting something different, often in the name of human or natural rights.”

The human rights community should be very afraid. What have they to fear from an obscure government commission, whose weird name is no doubt already being mocked in faculty lounges, and with a budget of $385,074? Not the commission itself, but what it stands for—a growing movement, both political and intellectual, that will, far from repudiating international law, redefine it so that it will advance right-wing causes.

We have seen this story before. In the 1970s, U.S. constitutional law theory was the product of liberal academics who sought to rationalize the rulings of the liberal Warren court. The community of liberal lawyers and law professors was insular, complacent, and like-minded, and it was entirely unprepared when the right launched a legal revolution that both drew on the work of mostly ignored and maligned dissidents; funded and encouraged a new generation of conservative lawyers who would populate the Federalist Society’s chapters and eventually the federal courts; and armed them with a usable conservative judicial ideology that could be used to roll back the Warren court rulings and entrench conservative commitments like gun rights in their stead.

The left took refuge in international human rights, and continued to fight a rearguard action by arguing that international human rights, as they saw them, trumped the increasingly conservative jurisprudence of the Supreme Court. Here, too, an insular, like-minded, and complacent group of lawyers, activists, and academics generated a left-of-center human rights ideology that is politically and intellectually vulnerable. It is easy to predict that we will see their arguments turned against them. Arguments that international human rights law—excuse me, “natural law”—should be used by the Court to reverse—what else?, Roe v. Wade—and ultimately overturn state laws that permit abortion, and should be used to strengthen property rights, religious freedoms, and gun rights will enter the mainstream.

Meanwhile, the liberal lawyers and political scientists who continue to insist that international human rights law takes precedence over national law might want to begin reconsidering their views.

Gaming out the confrontation between the president and the House

On common ownership; reply to Barry Ritholtz

The Bloomberg columnist Barry Ritholtz wrote an error-strewn response to some comments I made on the common ownership debate at a recent conference that was sponsored by Morningstar. I wrote the following letter to Bloomberg, which you can read if you own a Bloomberg terminal or hit the comments button after Ritholtz’s column. For everyone else, here is the letter:

Ritholtz does a disservice to readers by misrepresenting the important debate over common corporate share ownership. The debate began when a group of economists showed that airline-ticket prices have increased with the degree of common ownership of airlines — which means the extent to which institutional investors like BlackRock, Vanguard and State Street own (or have an effective ownership interest in) competing airlines. Economic theory tells us that when competing companies are owned or partly owned by common dominant shareholders, competition between the companies should decline, which is what the airlines study (along with another study on banking) suggests is happening.

Ritholtz makes several misleading assertions:

No. 1. He says that this theory is contradicted by the fact that investors have saved money by buying shares of the index funds offered by the Big Three. However, the critics like me do not deny that investors benefit by buying passive index funds. The critics argue that common ownership hurts consumers (or more broadly, people who lack significant stock holdings, which is to say most Americans). The problem is airline-ticket prices, not airline-stock prices, which of course should benefit from anticompetitive behavior.

No. 2. Ritholtz next says that the studies of airlines and banking that I cite do not take into account consolidation in the underlying industries. In fact, they do. Increasing common ownership aggravates the anticompetitive effects that arise from independently occurring consolidation at the industry level.

No. 3. Ritholtz says that I and the other critics ignore industries where prices have gone down. The problem with this argument is that you can’t simply look at prices. Prices reflect both costs and market structure; so even if concentration increases, prices may decline as technology advances. Although he is right that most industries have not been studied, no one has said otherwise.

No. 4. Ritholtz says that the criticisms of common ownership assume that the institutional investors “engage[d] in a criminal conspiracy to restrain trade and fix prices. Yet no one even tries to make this assertion.” For a good reason: he’s wrong that the critique assumes a criminal conspiracy. The theory is not that institutional investors agree with each other to fix prices. The theory is that the each institutional investor independently declines to pressure the firms it owns to compete with one another.

No. 5. Ritholtz says that in my view, “Vanguard, Blackrock, and State Street are going to throw out their investment philosophy, ignore their fiduciary obligations to their investors and risk vast reputational harm.” No, I assume only that the three institutional investors seek to maximize returns for their investors.

No. 6. Ritholtz suggests that the studies can’t be right because common ownership has existed for decades, all the way back to the 1960s. But there is no doubt that common ownership has increased dramatically over the last several decades. Common ownership will influence competition only when the common owners are the dominant shareholders of the competing firms, which was not the case in the past.

No. 7. Ritholtz suggests that my criticisms are focused on index funds, and that I’m on the side of active investors. That’s like saying that someone who opposes consolidation of the airline industry is opposed to air transportation and thinks everyone should walk. My worry is about the size of the institutional investors, which are now the largest owners of competing firms in numerous industries, not the products they offer.

Two pieces on antitrust law

In Law360 (paywall), I make the case for placing new limits on noncompetes.

In The Atlantic, I analyze Apple v. Pepper, the Supreme Court’s latest antitrust case.

Labor Monopsony and the Limits of the Law

My latest paper on the law and policy implications of labor monopsony strikes a more pessimistic note than earlier work. I argue (with Suresh Naidu) that in the best case, antitrust law can only make a dent in the labor monopsony problem. Other legal and policy approaches are needed, and we discuss some of them. Here is the abstract:

Recent literature has suggested that antitrust regulation is an appropriate response to labor market monopsony. This article qualifies the primacy of antitrust by arguing that a significant degree of labor market power is “frictional,” that is, without artificial barriers to entry or excessive concentration of employment. If monopsony is pervasive under conditions of laissez-faire, antitrust is likely to play only a partial role in remedying it, and other legal and policy instruments to intervene in the labor market will be required.

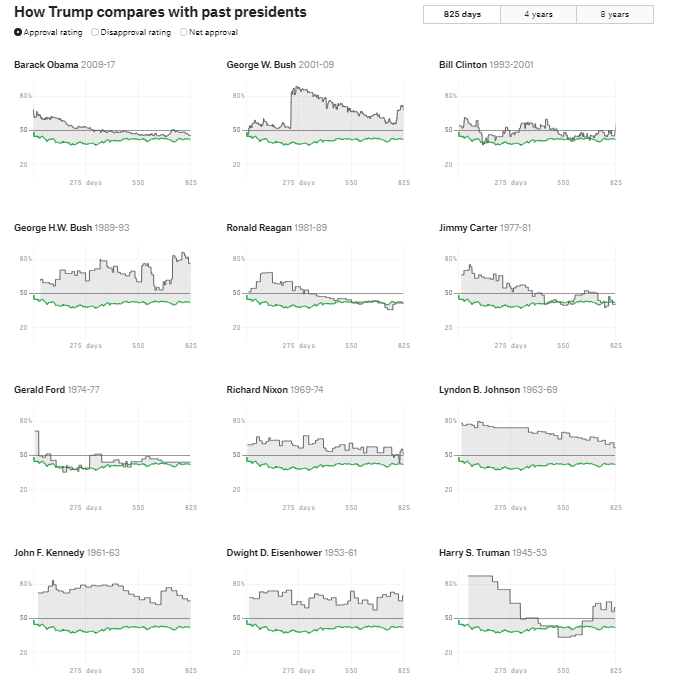

A remarkable fact about Trump’s poll numbers

They don’t budge. See the comparisons from 538 below. Unlike every other president’s poll numbers, Trump’s barely change in response to events. Why don’t people update their beliefs–pro or con–in response to his latest triumph or outrage? Possible answers:

- Nothing of significance has happened. Bush benefited from 9/11 and was hurt by the Iraq war, and Obama was hurt by continuing economic distress in the wake of the financial crisis. But not much has changed since Trump took office.

- People no longer tell the truth to pollsters, or polling results have become noisier because people no longer answer the phone. Something about how 538 aggregates poll results?

- People’s political commitments have become more tribal, and so they refuse to adjust their beliefs in response to information.

If #3 is right, then the Democrats should not expect that impeachment hearings will generate political support for impeachment, and would be wise to resist the temptation.

Trump and the internal separation of powers

In the Times, Daniel Hemel and I argue that the Mueller Report shows the presidency’s vulnerability to agency costs (though we don’t put it quite that way for the general reader). Our argument echoes some of the claims made by Neal Katyal in his 2006 article “Internal Separation of Powers,” but we are (or at least I am) more skeptical than Katyal and other authors that institutions within the executive branch can reproduce the “external” separation of powers, which was intended to keep the executive (as well as the other branches) in check in the first place, but seems to have failed.*

As we note in the piece, the mechanism in question—the ability of aides and other official in the executive branch to defy the president’s orders—is ambiguous in its normative implications. They can defy good orders as well as bad orders; they can constrain for good or ill, as the Hoover example was supposed to show.

The literature should pay more attention to within-executive branch mechanisms. Let me suggest two:

1. Selection. The president selects aides from a pool of candidates. The candidates differ along two dimensions: preferences (which might align more or less with the president’s) and ability. A president must make tradeoffs between the two dimensions. However, if a president wants to be effective, he must take account of talent, and if preferences are normally distributed, this will push him in the direction of the median. Thus, more extreme presidents will be moderated, and this seems to be what has happened with Trump. Most of his better aides disagree with Trump’s more extreme views and projects, while the cronies seem pretty incompetent. (Bannon and Miller have been the exceptions: apparently competent, though I’m not sure, as well as ideologically committed.) Of course, where executive-branch positions require senate approval, the extremist president will also be pushed toward the middle (as we are seeing with Fed nominations).

2. Ex post discipline. The president has very limited tools for rewarding or punishing his subordinates. To reward them, he can promote them, but promotions are limited and usually not very attractive to top officials who want to cash out by leaving government after a couple years. To punish them, he can publicly humiliate them, but he can’t, for example, throw them in jail. The president cannot give bonuses to loyal aides, nor can he (as we are learning) credibly offer them pardons in advance of breaking the law since aides rationally anticipate the president may never issue a pardon, which can be politically costly.

The biggest problem for the president is that officials can continue to pursue their careers in the private sector (or, later, in politics) only if they avoid being tainted by their service in the presidency. Lawyers face the risk of being disbarred if they engage in illegal or unethical conduct.

Both mechanisms suggest that the policies of a president like Trump can be moderated by internal executive-branch constraints (that is, agency costs), but they weaken as the elites polarize. If you imagine a bimodal distribution, for example, the president may find adequate talent away from median, and career opportunities might be available even to people whose actions offend much of the public. Moreover, the mechanisms will subvert a “good” president who seeks in good-faith to act in the public interest under conditions where most people (at least temporarily) disagree with him. (FDR ahead of World War II remains the preeminent example.)

The mechanisms, and particularly the second one, show how important it is for the president to maintain credibility. Subordinates who do not share his preferences need to be sure that he will punish them if they defy his wishes, and reward them if they obey. Executive Unbound argued that “for presidents, credibility is power…. Without credibility, the president is a helpless giant.” This seems to be an accurate enough prediction about Trump, and becoming more accurate every day.

* Note that there is a sense in which the separation of powers might be vindicated. The president was constrained by subordinates who feared being prosecuted under the obstruction of justice statute—which requires the involvement of the judiciary, as well as Congress, which needed to pass the statute in the first place. But this is not what people usually mean by the checking power of other branches. The statute remains dormant, and the judiciary uninvolved, unless the “executive branch” acts—by launching the investigation, cooperating with the investigation, and (ultimately) refusing to pardon.

The horror of the internet has three causes

1. As understood even 20 years ago, tech firms need to obtain network- (and/or IP-based) monopolies in order to earn returns that would justify the financial investment.

2. To obtain these monopolies, firms offered their products and services for free (Google, Facebook), or below cost (Amazon, Uber). While the companies did not so intend, their strategy had the short-time side-effect of generating enormous goodwill among consumers. (Remember this? “Amazon, as best I can tell, is a charitable organization being run by elements of the investment community for the benefit of consumers.”)

3. Once they obtained their monopolies, the tech firms rationally engaged in what economists call “rent-extraction”—raising prices or reducing costs by degrading service, which often took the form of violating promises to protect data privacy, bombarding users with ads, failing to maintain earlier quality standards, or all three. Consumers felt betrayed.

4. Meanwhile, the tech firms took advantage of consumers’ unfamiliarity with the new commercialized internet. People didn’t (and mostly still don’t) understand that:

a. When they reveal data about themselves in piecemeal, seemingly harmless ways, they enable tech firms to aggregate the data in ways that may compromise their privacy, autonomy, and even safety.

b. When they use convenient services on the internet, they are often being subtly manipulated in ways that make it difficult for them to stop using those services, even when those services are no longer convenient.

c. When they express their opinions on the internet where normal social cues and expectations are obscured, they often do so in ways that deeply offend, even enrage, people that they don’t want to offend or enrage, and would never try to do so in other settings.

People have been socialized in how to use the telephone, how to write letters, and how to talk to people in professional and social settings. They (still) haven’t been socialized in how to use the internet, especially social media. That will take years.

***

It’s the combination of monopoly power, technological manipulation of boundedly rational consumers, and consumers’ unfamiliarity with a new technology that makes the internet the hell that it is today. While most people will eventually figure it out, and both social and commercial institutions will socialize us and help protect us from manipulation, only government regulation can counter market power.

Mueller’s (implicit) finding that Trump obstructed justice

Mueller’s group believed that the president committed obstruction of justice. Mueller and his team interpret the law broadly (which is to say, correctly) and they recount numerous actions by the president that interfered with the investigation, and provide plenty of evidence of “corrupt” intent—meaning a desire to protect the presidency from embarrassment and possible criminal liability. Trump tried to cajole or intimidate Manafort, Cohen, and probably Flynn (some information was privileged), among others; and he tried to influence officials like Comey, Sessions, and Mueller himself. Moreover, Mueller (correctly, in my view) does not believe that separation-of-powers and other constitutional considerations give the president license to corruptly interfere with federal investigations.

Whey didn’t Mueller indict Trump? The answer is simple. Under Justice Department regulations, Mueller was bound by the (questionable) OLC decision that a president may not be indicted or criminally prosecuted while in office. While Mueller could have nonetheless announced his belief that Trump violated the law without filing an indictment, he believe that it would be unfair to make such an announcement. Without a speedy trial, the president would be left twisting in the wind, unable to defend himself before a jury of his peers. Thus, “while this report does not conclude that the President committed a crime, it also does not exonerate him.” I would say: the report does not officially conclude that the President committed a crime, but it clearly implies that he did.

Quadratic voting in the Colorado state legislature

Story here.

Bill Barr’s Memo Really is Wrong About Obstruction of Justice

Hemel and I reply to Andrew McCarthy’s defense of the Barr memo. Was our original op-ed “surprisingly vapid,” unsurprisingly vapid, or neither?

The Barr memo

Antitrust and Labor Monopsony

I have been thinking about labor monopsony lately. Recent academic research suggests that thousands of labor markets are highly concentrated. Labor monopsonists are on notice that any actions to maintain or advance their monopsonies are illegal. Surely such actions are common. Consider, for example, the thousands of mergers among employers, resulting in workplace closures in shared labor markets. Or a monopsonist who uses noncompetes to maintain or advance its control over a labor market.

So where is the litigation? Aside from a handful of cases brought by the government and private parties involving only the most explicit restraints of trade under section 1 of the Sherman Act, almost nothing. Why is antitrust litigation so much more common for product markets than for labor markets? Section 2 seems all but a dead letter for labor markets. Can it be resurrected for a world of ubiquitous labor monopsony?

Searching for answers, I have coauthored an academic article arguing that mergers should be reviewed for their labor market effects. Here is some testimony, further developed as a blog post. Also: a policy paper, an op-ed, a longer op-ed, and a podcast on Akerman WorkedUp with Matt Steinberg in which we discuss noncompetes.

Email me your insights. More to come.

Wisdom from the (distant) past

[Socrates:] And amid evils such as these will not he who is ill-governed in his own person–the tyrannical man, I mean–whom you just now decided to be the most miserable of all–will not he be yet more miserable when, instead of leading a private life, he is constrained by fortune to be a public tyrant? He has to be master of others when he is not master of himself: he is like a diseased or paralytic man who is compelled to pass his life, not in retirement, but fighting and combating with other men.

Yes, he [Glaucon] said, the similitude is most exact.

Is not his case utterly miserable? and does not the actual tyrant lead a worse life than he whose life you determined to be the worst?

Certainly.

He who is the real tyrant, whatever men may think, is the real slave, and is obliged to practise the greatest adulation and servility, and to be the flatterer of the vilest of mankind. He has desires which he is utterly unable to satisfy, and has more wants than any one, and is truly poor, if you know how to inspect the whole soul of him: all his life long he is beset with fear and is full of convulsions, and distractions, even as the State which he resembles: and surely the resemblance holds?

Very true, he said.

Moreover, as we were saying before, he grows worse from having power: he becomes and is of necessity more jealous, more faithless, more unjust, more friendless, more impious, than he was at first; he is the purveyor and cherisher of every sort of vice, and the consequence is that he is supremely miserable, and that he makes everybody else as miserable as himself.

No man of any sense will dispute your words.

–Plato, Republic.