I propose “altruism exchanges” in Slate, based on an article I wrote with Steven Choi and Mitu Gulati.

Category Archives: MISC.

Eric Holder

He marched down the trail blazed by John Ashcroft and Alberto Gonzales. Or so I argue in Slate.

How could Obama rely on the 2001 AUMF to justify hostilities against ISIS?

Here is Ryan Goodman:

I have previously written that the 2001 authorization does not cover ISIS, and I noted: “As readers of Just Security, Lawfare, and Opinion Juris know, a remarkable consensus of opinion has emerged across our blogs that ISIS is not covered by the 2001 AUMF.”

Yet the White House ignored this remarkable academic consensus. Why? Well, remember the 2011 Libya war when the White House circumvented the War Powers Act by defining “hostilities” to exclude the act of raining down bombs and missiles on hostile troops? This broad interpretation of the 2001 AUMF is effectively a narrowing to nothing of the War Powers Act, henceforth, for all military activity directed against Islamic terrorists in the foreseeable future. Is it still possible to find this surprising?

The simple explanation is that in many settings–Libya, and, one supposes, this one–it is jointly in the interest of the president and relevant members of Congress to avoid a congressional vote that might force those members of Congress (specifically, Democrats right before an election) to go on record with a position that the party demands but their constituents reject.

Podcast: Online privacy for public figures in the social media age

I debate (well, mostly agree with) Marc Rotenberg of the Electronic Privacy Information Center. You can find the podcast here:

July 4 in Chicago: A reply to Reihan Salam

Various commentators seem to be shocked by my claim that the president can refuse to enforce the immigration laws. They think that such an action would violate the Constitution. No lawyer does, aside from a few with idiosyncratic views about the Constitution. Let me see if I can explain why.

Last July 4, I took a stroll along the Chicago lakefront in my neighborhood. As far as the eye could see, ordinary people were setting off fireworks, and not just everyday firecrackers, but what seemed like commercial-grade fireworks that showered sparks on us from high in the air. Numerous police officers stood around and watched. Even though fireworks (beyond smoke bombs and sparklers) are quite illegal in Chicago, no one moved to make an arrest or even issue a warning.

This is a familiar example of executive discretion. Hundreds of people violated the law. The police did nothing about it. Why not? Maybe because they did not have enough resources. Maybe because the mayor thought arrests would be unpopular. Maybe because the police enjoyed the fireworks display. Who knows? It doesn’t matter. No one thinks that the city government behaved unconstitutionally though quite a few citizens complained. (This has been going on for many years.)

Obama’s (apparent) plan not to enforce immigration laws is just another example. His critics have worked hard to distinguish it from run-of-the-mill enforcement discretion that the Constitution places in the executive branch. Reihan Salam makes several attempts.

First, the president can use his law enforcement discretion to “husband enforcement resources” but only to advance the immigration law, and that’s not what he’s doing. But Chicago did not “husband enforcement resources” to advance “fireworks law.” It simply disregarded the fireworks ordinance. It husbanded resources for goals (for example, keeping order) that it deemed more important than stopping people from shooting off fireworks. There is no rule that enforcement discretion is somehow law-specific.

Second, Salam argues that the president can’t do what Congress didn’t intend. Congress didn’t intend to allow the president to give work permits to millions of illegal immigrants. True, but state and city lawmakers didn’t intend to allow Chicago police not to enforce the fireworks law. Or, to draw a closer parallel, to give fireworks permits to thousands of amateurs. The law reveals an intent that is exactly the opposite.

Third, the president can’t prospectively “suspend” the law. (He’s not suspending it–he can’t do that–but never mind.) Here we see a difference. The Chicago police do not announce in advance that it will suspend the law requiring people to obtain a license to shoot off fireworks. That the police are issuing “fireworks permits” hither and yon, akin to Obama’s work permits. But everyone knows that this is the policy. No one has explained why announcement of prospective action–which serves important rule-of-law values by informing the public of policy–is a defect rather than an improvement over the Bush era, where virtually no employer was ever punished for employing illegal immigrants but a policy of non-enforcement was never announced.

Question: How many employers were punished by the Bush administration in 2006 for employing illegal immigrants? Answer: zero. It’s true that he didn’t announce a policy of granting work permits to illegal aliens. But that was his policy. Why didn’t Salam argue then that Bush was violating the Constitution?

The truth is that a huge number of laws are simply not enforced. An old example that people used to cite are sodomy laws. They were on the books; they were occasionally used against rapists when a jury couldn’t be persuaded that the victim withheld consent. Sodomy laws were virtually never enforced against (otherwise) law-abiding people. All kinds of old laws sit on the books that no one bothers to enforce. And not just crazy old state laws. There are thousands of intricate regulatory laws governing industries of various sorts that are never or selectively enforced.

Environmentalists and other advocates have complained for decades about executive-branch policy (yes, explicit and prospective) of issuing rules under regulatory statutes like the Clean Air Act only if those rules pass cost-benefit tests. This policy was first implemented by Reagan in 1981. The policy is plainly one of under- or non-enforcement of the law, which contains no such cost-benefit test but rather requires strict regulation. Yet I’m guessing that Salam and Douthat don’t see this policy as an example of “domestic Caesarism.” Why not, exactly?

Or if you want still more examples, consider the well-recognized phenomenon of “regulatory forbearance” in banking law where banking regulators decline to shut down a sick bank despite its violation of capital-adequacy regulations because they think it will recover. Or consider the endless statutes that ban “loitering,” “disorderly conduct,” “breach of the peace,” and the like. If police had to literally enforce these laws, we’d all be in jail. So if you wonder why courts never try to force the executive branch to enforce the law, this is why.

All that is different about the immigration example is that it is currently a hot-button political issue. As Salam seems to recognize implicitly as his piece winds down, the president is (or may be) violating a political norm, not a constitutional norm. And for that reason his decision may be a bad idea, and perhaps it will backfire. But that doesn’t make it unconstitutional.

On Douthat’s Sunday column

Douthat thinks that Obama’s immigration plan would be “lawless, reckless, a leap into the antidemocratic dark.” I think it would be business as usual, as I argue in TNR. It’s an interesting feature of political discourse that many people, Douthat included, confuse separation-of-powers and legislative supremacy.

Supreme Court breakfast table

Here are my entries.

1. Riley.

2. Noel Canning.

3. Hobby Lobby 1 (and McCullen).

4. Hobby Lobby 2.

6. Bonus (except you have to pay for it) Podcast with Dahlia Lithwick.

Piketty, chs. 3-4

These chapters describe changes in the capital/income ratio over time in several countries. A high capital/income ratio means that capitalists gain a large portion of national wealth, signifying inequality (given that the wealthy own most of the capital). It’s a bit hard to comment on these chapters since they are part of the larger argument in Part 2, but here are some thoughts.

1. Piketty’s main point is that the capital/income ratio in the UK, France, the US, etc., has changed little over the centuries aside from a major dip around World War I and World War II (a minor dip in the US). The message is that capital-driven inequality is alive and well, and not much different from the bad old days of Austen and Balzac.

2. The dip, however, has created the illusion that inequality is getting better–this is what fooled Kuznets. The wars displaced us from long-run trends but only temporarily.

3. It is true that change has occurred–but the change has been in the composition of capital, not its contribution to national income. Agriculture is less important than it was; manufacturing more important. Like the dip, changes in the composition of capital has distracted observers, causing them to overlook the long-term trends in inequality and the role of capital in those trends. These superficial changes in the form that capital takes prevents us from seeing that our society is fundamentally the same as Austen/Balzac’s.

4. It is noteworthy that in recent years, the contribution of housing to the composition of capital has increased dramatically. This has given rise to some debate about whether this is consistent with Piketty’s thesis. I haven’t tried to understand this debate. You can read about it here.

5. Piketty is often most interesting in his sly asides. In a few places, he distinguishes “rent-seeking” or “quiet” capital from “productive” or “risk-taking” capital. I look forward to seeing whether and how he develops this idea. But the implication is that beyond the capital/income ratio, there is a question of when capital is socially good and when it is socially bad.

Here is my last post on Piketty.

Rappers v. Scotus

Definitely the silliest thing I’ve ever written.

UPDATE: I’ve been told that I’ve written sillier things.

Piketty, chs. 1-2

I’m meeting with some colleagues over the summer to discuss Thomas Piketty’s new book, Capital in the Twenty-First Century. We’re reading two chapters every week, and I’m going to post my thoughts as we go along. You can think of this as a slow-motion book review.

I’m meeting with some colleagues over the summer to discuss Thomas Piketty’s new book, Capital in the Twenty-First Century. We’re reading two chapters every week, and I’m going to post my thoughts as we go along. You can think of this as a slow-motion book review.

Chapter 1 provides an overview, and Chapter 2 mainly discusses concepts, so it’s premature to comment on Piketty’s main argument. Indeed, as I go along, I’ll probably need to revise initial impressions in light of later chapters. That said, here are some comments on the first two chapters.

1. Piketty places himself in an intellectual tradition of economists who are concerned with growth and inequality, above all Ricardo, Marx, and Kuznets. Piketty praises each for focusing on these issues, for attending to empirical realities (particularly Kuznets who puts together the first usable data set), and for proposing a theory about the long-term trend of inequality. And he criticizes each for being, well, wrong, and specifically for extrapolating on the basis of inadequate data.

And my first thought is how these comments rebound on Piketty’s own project. One key issue is to what extent can he reliably extrapolate based on his own (much better data). Kuznets was wrong in extrapolating a downward trend in inequality on the basis of his limited data, and so we have to wonder about the basis for extrapolating an upward trend in inequality on the basis of Piketty’s significantly better but still limited data. One notable point is that Piketty extrapolates low long-term economic growth (a key variable in his theory) on the basis of many hundreds of years of history rather than going back to (say) the industrial revolution or later. Is that the right assumption?

2. I suspect, based more on the reviews than on what I have read so far, but partly on that as well, that we will see two Pikettys, or rather two theses:

a. The weak thesis: there is (contra Kuznets) no law that inequality declines with growth; it could go up or down. No one knows.

b. The strong thesis: there is a law that (also contra Kuznets) inequality will increase with growth.

I’m interested to see how this plays out. The weak thesis may contradict some popular right-wing misconceptions but as an academic theory it’s pretty, well, weak. As Piketty acknowledges, Kuznets himself did not consider his own law anything more than speculative. The strong thesis is much more exciting and important, but may end up being just as speculative as Kuznets’.

3. Another issue that I will revisit as I learn more is what exactly we should think about inequality. Piketty is not very clear about this so far. He hints that inequality could lead to very bad outcomes–revolutions, or an oligarchy, or social instability–or maybe it is inherently objectionable. A very old question is whether inequality is worth tolerating for the sake of growth if the bottom rises. Piketty is already clear that we can’t assume that this is the case; nonetheless, we need to know what we think about this before we propose reforms that might improve equality but suppress growth.

4. Finally, I was struck by an interesting observation that Piketty makes in passing about development. He argues that the development success stories–China, South Korea, Japan, and so on–benefited from free trade but not from foreign investment. Meanwhile, foreign investment has actually harmed many countries, especially in Africa and maybe Latin America, because poor members of the public resent foreign wealth in their midst and support populist governments that expropriate foreign investment and destroy the economy. Is there empirical evidence for this argument?, I wonder. If it’s right, it has important implications for how best to help developing countries (namely, don’t invest in them!).

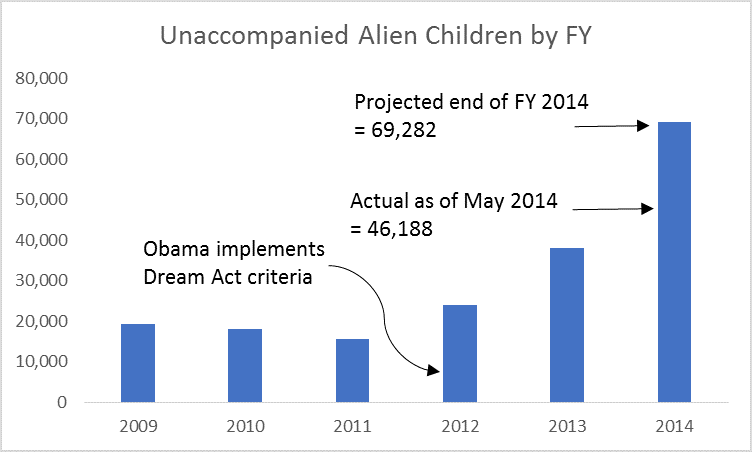

Minors illegally entering the United States and the Dream Act

The New York Times reports an upsurge in the number of unaccompanied minors who are entering the United States illegally across the southwest border. I found the data here, and produced the graph above. The data are through May, and so for 2014 I indicate the actual number as well as an estimate through the end of the fiscal year.

The New York Times reports an upsurge in the number of unaccompanied minors who are entering the United States illegally across the southwest border. I found the data here, and produced the graph above. The data are through May, and so for 2014 I indicate the actual number as well as an estimate through the end of the fiscal year.

What is the source of this wave of illegal migration? The obvious explanation, documented anecdotally in the Times article, is that people living in (mainly) Central America believe that the U.S. government will not deport minors, based on President Obama’s implementation of the Dream Act criteria and other immigration policies.

The administration blames rising crime rates in central America. But while Honduras remains a very dangerous place, homicide rates peaked in El Salvador and Guatemala years ago, and have been declining over the period in which the migration of unaccompanied minors to the United States rose.

Presidential power and national security: the prisoner exchange

A nice illustration of the limits of congressional power. Congress passed the National Defense Authorization Act of 2014, which provided that if the president wants to transfer Guantanamo detainees to foreign countries, he must give Congress 30 days notice, so that it can raise a stink. The president refused to do so before the prisoner exchange since the negotiations took place in secret, and he could not afford the risk that even if he could inform Congress secretly, a leak would occur.

The transfer may have violated the substantive provisions of the statute as well. The statute provides that a detainee can be transferred only if he is no longer a threat to U.S. national security or the transfer is pursuant to a court order. But there was no such court order, and the five Taliban members who were transferred appear to be dangerous people. So much for the statute.

As Marty Lederman notes, the president paved the way with a signing statement that said that the law conflicts with “separation of powers principles.” A nice echo of the Bush administration, and a reminder that the imperial presidency is bipartisan.

The normal distribution

Paroline v. United States

A good case for a class on remedies, it features an unusual harm. “Amy,” a victim of child pornography, is emotionally traumatized when she learns that thousands of people view images of her on the web. Paroline is one of those people, and she seeks restitution from him. It’s not entirely clear to me that he even contributed to the harm, but if he did, determining how much money he should pay her on account of that contribution is a challenge. What is unusual about Amy’s injury is that it requires a large number of contributors but above a threshold additional contributors do not increase the harm. Some thoughts on the case at Slate. There is a good academic paper on the topic, making a similar argument, by Jenna Sheldon-Sherman.

Reply to my post on Social Security overpayments, and a reply to the reply

A former student who works for Social Security responds to yesterday’s post:

I read your blog post today on Social Security overpayments and wanted to respond briefly (in my personal capacity, of course, and so my opinions don’t necessarily represent Social Security’s official policy on the matter). I think you’re seriously mistaken about the source of the agency’s claim to recoup alleged overpayments. Rather than a common-law argument of unjust enrichment, the Social Security Act and implementing regulations offer specific authority to collect overpayments using a variety of methods, including tax refund offsets.

The source of authority for collecting overpayments from claimants who received Title II benefits lies in Section 204 of the Social Security Act (codified at 42 USC 404). That statute allows Social Security to prescribe regulations to implement the overpayment process. 20 CFR 404.502 details the specific means by which the agency may collect overpayments. 20 CFR 404.502(b) covers situations when the individual overpaid dies before the adjustment is made, and 404.502(b)(3) specifies that such adjustment can be made by “withholding a lump sum or monthly benefits due any other individual on the basis of the same earnings which were the basis of the overpayment to the deceased overpaid individual”. In the case of the Post story, both Sadie Grice and Mary Grice were entitled to benefits based on the father’s earnings record (some combination of widow’s benefits, mother’s benefits, or child’s benefits, I would guess, though I don’t know for sure and have no personal knowledge of the case other than what’s in the Post article). Therefore, 404.502 would arguably allow collection of the overpayment from Mary because she received benefits on the same earnings record as Sadie did, and Sadie was mistakenly overpaid. 20 CFR 404.520 then permits the overpayment to be referred to the Treasury if the debt is certain in amount, past due, and legally enforceable, for a tax refund offset.

If the benefits in question were child’s benefits that Mary was entitled to solely because she was a minor child of an insured individual (20 CFR 404.350), that’s her entitlement, not her mother’s even though her mother acted as her representative payee because she was 4 years old when she gained the entitlement. I’m a little more unclear on how it would work if Sadie was receiving mother’s benefits (20 CFR 404.339) because of the minor children, but that presumed she wasn’t entitled to widow’s benefits in her own right. In any case, while the propriety of trying to collect such old debts is arguable and the agency should certainly be held to prove the overpayment occurred on the stated earnings record in the specified amount, I feel certain the agency is not relying on a common-law theory of unjust enrichment to do so.

Point taken, but I still believe that this program would not be upheld in court (and perhaps the author of the email agrees in part). I haven’t look at the regulations, but the regulations must be consistent with the statute, and 42 USC 404(b) contains this provision:

In any case in which more than the correct amount of payment has been made, there shall be no adjustment of payments to, or recovery by the United States from, any person who is without fault if such adjustment or recovery would defeat the purpose of this title or would be against equity and good conscience. In making for purposes of this subsection any determination of whether any individual is without fault, the Commissioner of Social Security shall specifically take into account any physical, mental, educational, or linguistic limitation such individual may have (including any lack of facility with the English language).

So the common law (or technically, equity) is relevant after all. And this means, among other things, the doctrine of laches would apply (even if Congress has suspended the statute of limitations); and equity would frown on (as they say) recovery from Mary on account of payments that Sadie may not have no turned over to her, may have spent on herself or the other kids, and so on. Clearly, as a four-year old, Mary was without fault; and the last sentence of the provision would seem to further strengthen her argument. Finally, consider again the policy of going after the oldest child alone for overpayments that benefited all the children if at all; this too is not explicitly authorized by the statute, and would, I am fairly certain, not be considered equitable by a court.

Can the government recover from children on account of Social Security overpayments to their parents?

According to a report in the Washington Post, the government does just that.

A few weeks ago, with no notice, the U.S. government intercepted Mary Grice’s tax refunds from both the IRS and the state of Maryland. Grice had no idea that Uncle Sam had seized her money until some days later, when she got a letter saying that her refund had gone to satisfy an old debt to the government — a very old debt.

When Grice was 4, back in 1960, her father died, leaving her mother with five children to raise. Until the kids turned 18, Sadie Grice got survivor benefits from Social Security to help feed and clothe them.

Now, Social Security claims it overpaid someone in the Grice family — it’s not sure who — in 1977. After 37 years of silence, four years after Sadie Grice died, the government is coming after her daughter. Why the feds chose to take Mary’s money, rather than her surviving siblings’, is a mystery.

If, as I think, the government’s claim is based on common law principles (as opposed to specific statutory authorizations), it’s claim is probably invalid. The issue is not the age of the claim–as the article notes, Congress eliminated the statute of limitations for government claims of this sort. Nor is this a case of a child inheriting the debts of a parent. In a way, this is a run-of-the-mill unjust enrichment case. Consider this simplified version.

The government overpays Sadie on account of her Social Security benefits. Sadie, unaware of the error, cashes the check and gives the proceeds to Mary. Neither knows of the error. The government is entitled to obtain restitution from Sadie or Mary.

Putting aside the time lag, this is our case. But there is a problem for the government. It has no evidence that Sadie spent the money on Mary, as opposed to her other children, or for that matter on herself. (Maybe the law required Sadie to spend the money on her children, but if she didn’t, the government has a (defunct) claim against Sadie, not against the children.) According to the Washington Post:

The government doesn’t look into exactly who got the overpayment; the policy is to seek compensation from the oldest sibling and work down through the family until the debt is paid.

I can almost imagine why this crazy policy was (presumably) approved by government lawyers. If you have a valid restitution claim against multiple people, you can go after whoever you want; you don’t have to go after all of them. The purpose of the payments was to benefit the children, and so overpayment would have benefited all of them, if it was spent on them. And so if it’s easiest to start with the eldest sibling, that’s a policy judgment that is consistent with the law.

But under the principles of unjust enrichment, the government needs to prove that Mary actually received money from Sadie, or that the money was spent on her in a way that made her better off. It can’t.

Getting Incentives Right by Cooter and Porat

This is a very good book, which milks insights out of two dead-ish fields–torts and contracts–and one that has never come to life–restitution. I’m impressed by the creativity of the authors. My favorite of their many ideas is “anti-insurance”–where two contract parties agree that if the promisor breaches, he must pay damages to a third party (who pays for the privilege) rather than to the promisee. This mechanism prevents the promisee from relying excessively on performance while preserving the promisor’s incentive not to breach unless efficient to do so. It’s called anti-insurance because it eliminates the promisee’s right to damages (a kind of insurance) in case of breach.

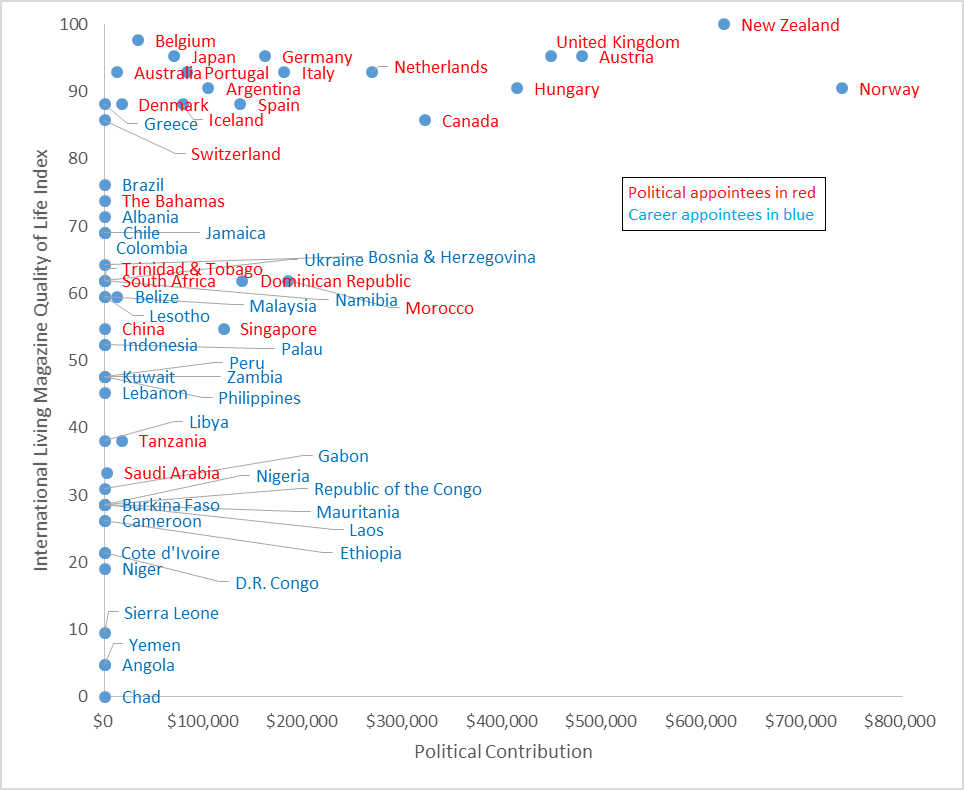

How to procure a (nice) ambassadorship in the Obama administration

Sources: AFSA; OpenSecrets (2008-2012 contributions to Obama or Democrats); International Living (2011 data). For clarity, I expanded the range of index scores for the countries used in the graph from 34-76 to 0-100.

The paranoid libertarian and the angry liberal

A meditation on our political culture.

A statute to solve the debt-ceiling impasses once and for all?

I argue for such a statute here.